PTO and PTA groups are an essential part of school community. With their help, events run smoothly, students stay safe, and schools meet their fundraising goals. Did you know most school PTO and PTA groups, as independent organizations, are not covered by the district or school insurance? If they are, the policy may not cover events after school hours or off school property. It is crucial to ensure your district’s parent groups are covered, and for them to get insurance if they’re not!

Unfortunately, despite even the tightest safeguards, students can still get hurt and property can be damaged. While parent groups are volunteers, they can still be held responsible in an incident. As such, insurance is a must.

Yes, Your PTO and PTA Groups Need Insurance.

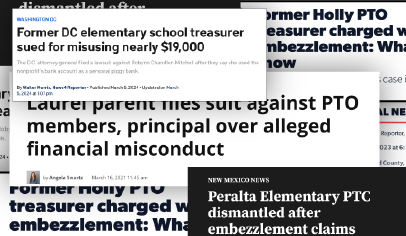

There’s no telling what can happen at school events. Safety concerns and property damage are not the only potential threats to your parent groups–volunteers can be victims of embezzlement, theft, and mismanagement claims that could be deterred and protected by insurance.

What Kind of Insurance Should They Have?

As you can imagine, there’s a lot to consider when choosing PTO and PTA insurance, and it’s difficult to determine just what your needs are. PTO Today’s Insurance Packages are specifically designed to cover volunteers who spend their time and energy ensuring your district’s events are successful. With the unique role these volunteers play in mind, here’s what PTO Today Insurance will cover:

General liability: This covers common school events like ice cream socials and auctions, and includes coverage in the event of third-party bodily injury or property damage claims. This means you’re protected if someone were to be unintentionally harmed at an event (ex. tripping over a cable) and sustained a minor injury.

(Plus, many venues won’t allow your group to use their space if you aren’t insured!)

Excess accident medical: Excess accident medical coverage helps pay for out-of-pocket medical expenses incurred by a participant due to an accident at a sponsored activity or covered event.

Directors and officers: This policy is truly an investment in the leaders of your group. It covers claims directed at an organization’s individual officers/board members resulting from decisions made on your group’s behalf.

Crime insurance: This protects your group from embezzlement, theft, or loss of funds.

Property insurance: This protects property owned by the parent group, such as a cotton candy machine, fundraising merchandise, and computers, against damage or loss from theft or natural disaster.

Ease Your Mind

PTO Today’s insurance package is effective as soon as midnight the next day. Once your payment has been processed and your application is approved, you’re good to go.

Plus, there’s a variety of insurance packages to choose from, meaning you’re in control while determining what’s best for you and your PTO/A groups.

Learn More

PTO Today is a great resource of all things PTO Insurance. You can download their insurance brochure here so you can have the best, most up-to-date information they have to offer.

And if you still have questions, you can reach PTO Today at insurance@ptotoday.com